Introduction:

- Order-to-cash can be chaotic when more than two Medtech companies merge to become a prominent industry leader.

- There are many order-to-cash processes available in the market. Hence, choosing and planning the right OTC implementation is crucial.

- This blog throws lights on three top OTC integration tips from the C level perspective to accelerate revenue growth.

When two businesses merge, the sales territories overlap, and it creates significant channel conflicts. Merging of business is nothing new, and when two merge, the sole common aim is to create a high-growth market leader. Order-to-Cash or OTC plays a significant role in such a situation to streamline the supply chain, commercial, and back-office functions without any hassle.

According to a Deloitte case study, a US-based medical device company faced the conflict of overlapping sales territories while merging with another medical device manufacturer. Their OTC processes needed the right integration models. However, the OTC integration they selected didn’t address back-office and supply chain operations. The two medical device companies deployed their sales team in open territories having an opportunity to cross-sell products together. With time, the merged entities were able to accelerate the revenue growth of their deals.

Hence, the leadership should decide how the OTC process will align the business priorities and a reasonable integration effort. The Order-to-Cash can be a vital enabler of cross-selling for merged medical device manufacturing companies. And the OTC lifecycle is a complex one. Hence, the leadership should have the strategic, focused ideas on areas that need the most improvement and align with company goals. How the new medical equipment manufacturing company accelerate revenue growth potential with Order-to-Cash?

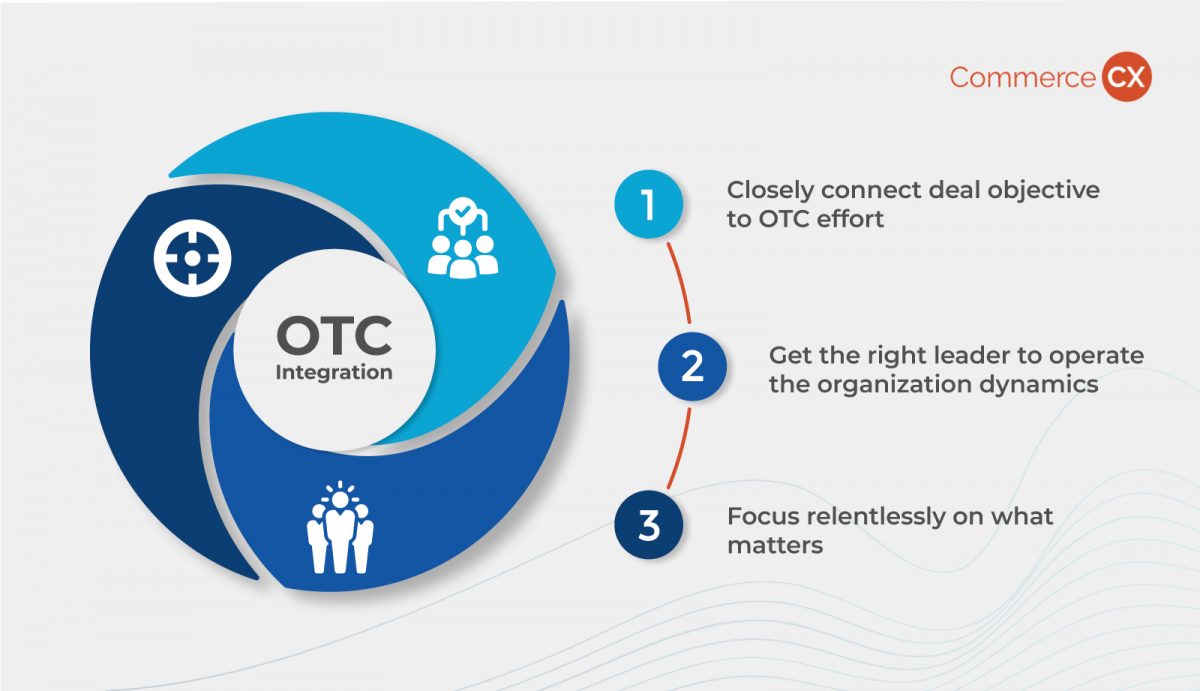

The Top 3 OTC Integration Tips

Here, we will discuss the top three order-to-cash integration tips for successfully merging MedTech companies:

Closely connect deal objective to OTC effort.

As a first step, both medical equipment manufacturing companies need to recognize how broader Order-to-Cash integration fits the deal objective. There are different order-to-cash models in the market. Choosing the right model is essential. For instance, the OTC Integration model, such as the “Quick wins model” is the best for driving growth, and a “Fully integrated model” is suitable for cost optimization.

Get the right leader to operate the organization dynamics.

After deciding the right order-to-cash integration model, the medical equipment manufacturing company should build a centralized leadership team. This team will create a custom OTC integration model to drive the organizational growth and agenda. You must define governance as early as possible. Having operational efficiency is also crucial for the C level (C-level) team.

Focus relentlessly on what matters

The ability to manage the broad changes while adapting the order-to-cash integration is essential for MedTech companies to stay in tandem with customer needs. You must train your employees to cope with the new way of working and cater to customer requirements. A carefully planned order-to-cash integration is steadier than a broad integration to drive future revenue growth.

Plan Order-to-cash Integration with us

At CommerceCX, we help you plan a thoughtful order-to-cash implementation process to streamline your customer needs and order management with an e-signature platform. We are a silver Salesforce partner to bring the best OTC process with adept and certified Salesforce professionals. Our team considers your custom requirement while paving a straightforward way for order-to-cash implementation.

Get in touch with us for a suitable OTC implementation.

About CommerceCX: CommerceCX is a global consulting, design, and development firm. We provide organizations with the solutions and services that support the transformation of a commerce ecosystem. We specialize in CRM, Quote-to-Cash, Lead to Cash, and have strong Salesforce, Apttus, and Microsoft Technologies expertise. Leveraging our solutions, organizations can connect technology, data, and insights to unify and enhance the buying, selling, and service experience that powers the commerce ecosystem.