Highlights

- Order to Cash supplements your order management process with automation, accuracy, and predictability.

- Industries, including e-commerce, healthcare device manufacturers, medical equipment manufacturers, pharmaceuticals, and healthcare organizations, can go for OTC implementation.

- This blog discusses OTC’s core concept, business values and benefits, and how it can change your business strategies.

Order to Cash or OTC is demanding for businesses in an ever-growing digital economy. It brings efficiency and accuracy to the processes and inspires businesses to give a better financial performance. OTC also drives the relationship between customers and businesses. If you optimize your existing O2C process, it will help you to focus on fulfilling bulk orders on time. OTC is an integral part of the Quote to Cash process helping your business focus on a more customer-centric approach. The goal is to automate and streamline your sales cycle with the QTC process and custom implementations. Further, predicting revenue with accurate billing and cash flow is also one of the prime benefits businesses avail while implementing the QTC process.

Read here to know everything about the QTC process!

What is Order to Cash?

Order-to-cash is your order processing system that begins when your customers place orders. Activities like branding, marketing, and customer acquisition follow the OTC process. It doesn’t end with receiving and paying orders. Involving many processes, OTC calls for optimization so that you can identify the opportunities for improvements.

OTC encompasses all the processes involving receiving orders, payment, and making an entry in the accounts.

How does OTC work?

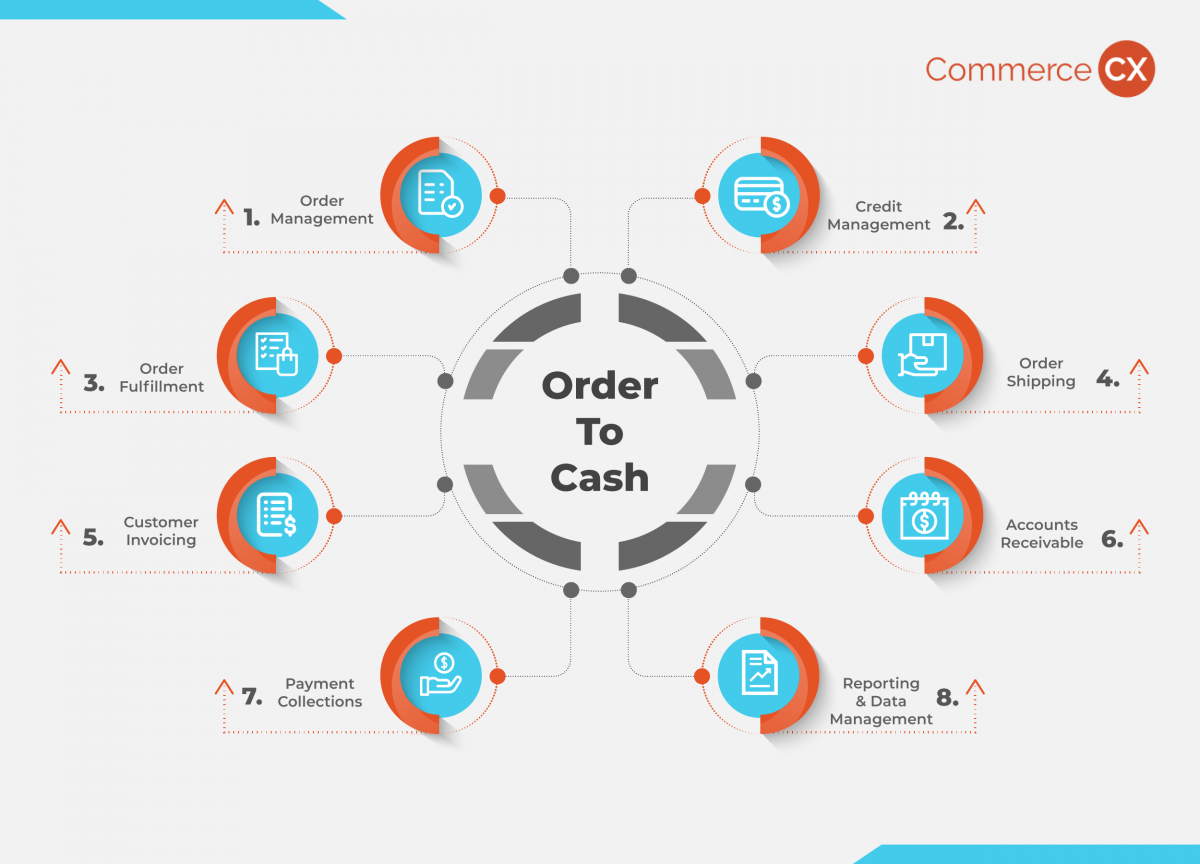

Order-to-Cash involves an eight-step process. It starts with order management and ends with reporting and data management. Businesses and customers go through all these eight steps to fulfill any orders. Let’s see how OTC works with an infographic:

OTC Impact on your business

OTC has an overall impact on your business, including supply chain management, labor, and inventory management. If these units are entirely separate from each other, it can create a bottleneck. Besides, if there is any delay in bill collection, it can complicate payroll acquisition, account receivable, and other liquidity issues. Hence, managing an OTC process is not an easy job. But when you know the optimizing tricks, it can create some magic numbers by benefitting your business:

How can OTC change your business?

Suppose you optimize your OTC with the right technology platform. In that case, it can streamline your entire order process by automating data cleansing, enforcing centralized credit, evaluating new accounts for credit quality, etc. Let’s discuss how OTC can change your business:

Manage your orders with an automated process

How do you handle bulk orders? It creates a lot of mess, managing all orders manually. But OTC can automate managing your orders. It pushes instant notification for any series of actions and helps you stay on the top of your order. An IBM study says that businesses adapting OTC are 81% more efficient in order management.

Manage your credit with diligence

OTC ( or O2C ) helps you with diligent credit management to minimize issues. It enables you to apply for credit automatically wherever credit is applicable. Besides, it sends the credit through an approval process upon setting approval rules. OTC can take care of straightforward approvals or denials or notify the finance dept for a thorough review.

Automated credit management ensures more straightforward accounts receivable, and strategic credit guidelines also enable you to issue credit only to worthy customers.

Fulfill orders with automated inventory management

OTC enables you to have automated inventory management software. It automatically updates inventory counts in real-time on the sales side and avoids accepting, which can’t be fulfilled. It immediately flags ‘out-of-stock’ in such situations. Then you can alert your customers to cancel orders.

It also keeps all the orders you send for fulfillment in digital formats. Any associate can view all the relevant details, and OTC helps you to do that.

Ship your orders flawlessly

The better your product logistics are, the more successful your shipping is! And OTC regularly audits the shippings to make this happen. It updates order fulfillment data immediately for the shipping team. It enables you to plan the shipments schedule and deliver orders to the customers on time.

Customer invoicing on time

Invoicing delays and inaccuracies are common problems businesses face in the order lifecycle. Order-to-Cash empowers your business to send accurate invoices on time so that the finance team can predict the cash flows and plan expenses accordingly. Research reveals that businesses implementing OTC need manual input of only 16.2% of invoices.

Automate your accounting systems

When you optimize your OTC process, you can automate your accounting system. It helps you to flag outstanding invoices at predefined times before they get overdue.

The accounts receivable representatives need to review these invoices to find if any errors would result in late payment. When you detect the mistakes, the accounts receivables professionals can review the data quickly and revise it on time.

Collect payment on time

Sometimes businesses encounter issues when payments don’t get processed in the ordering system and show as unpaid. It creates problems when customers are requested to pay again. During any official lapsing of invoices, you flag the customer and put their credit on hold. But OTC alerts such customers to pay before completing their next orders. In such a case, the account receivable team can contact the customers immediately.

Enhance reporting and data management

The Order-to-cash process can monitor and analyze data at every stage of the ordering system. If you customize and optimize the OTC as per your requirements, you can deliver the customer’s value as promised. Besides, OTC helps you calculate, analyze, and report all data in an ordering process by empowering your business with correct cash flow predictability.

Implement OTC with CommerceCX

When you implement OTC with us, you streamline order management and renewal management with e-signature for the e-commerce and healthcare sectors. Being a sliver Salesforce partner, we bring their OTC process to your unique business system with customized flavor. We have a team of certified Salesforce professionals who understand your requirements and make the implementation process easy and straightforward.

Get in touch with us to automate orders with our custom OTC implementation.

About CommerceCX: CommerceCX is a global consulting, design, and development firm. We provide organizations with the solutions and services that support the transformation of a commerce ecosystem. We specialize in CRM, Quote-to-Cash, Lead to Cash, and have strong Salesforce, Apttus, and Microsoft Technologies expertise. Leveraging our solutions, organizations can connect technology, data, and insights to unify and enhance the buying, selling, and service experience that powers the commerce ecosystem.