Cash flow is the lifeline of your business. In simple words, cash flow refers to the cash businesses receive or give out to the creditors via payments. If you are clueless about cash flow in your business, it is a bad financial symptom. As per Jessie Hagen of the US Bank, poor cash flow is 82% responsible for the financial failure of businesses.

While revenue means how much money is coming to your business. Both cash flow and revenue are crucial factors in every business and clear visibility of the same is essential. When you can see your cash flow, it helps you to forecast your revenue. It also helps you to understand the best practices for financial resilience.

Around 30% of healthcare companies have low visibility on revenue as well as cost due to complicated and messy sales cycles. Here a critical question pops up.

How can businesses track and recognize revenue in advance?

With custom QTC implementation, we offer a customized technology platform for pharmaceuticals, biotechnology, equipment, distribution, and facilities by enabling them to recognize and forecast revenue.

Implement QTC with us to recognize your revenue

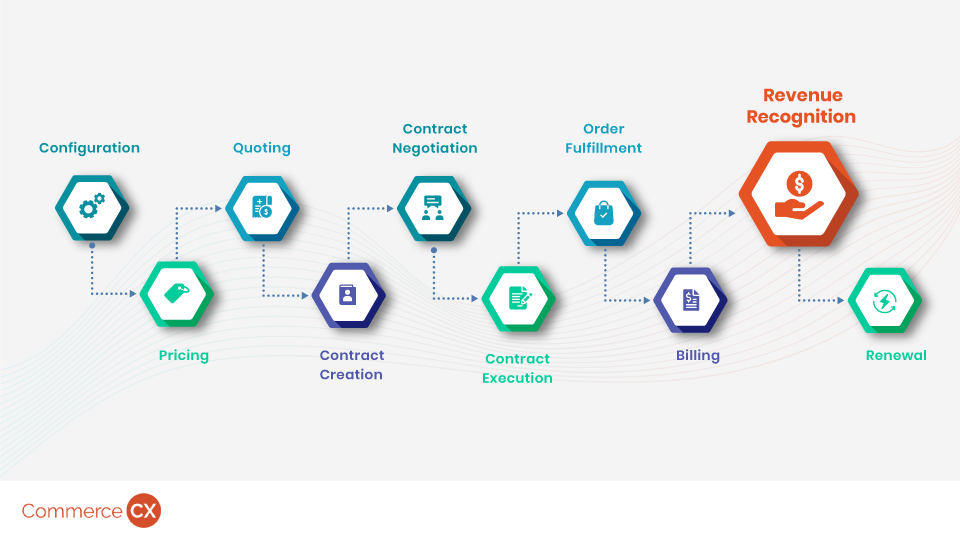

Quote-to-Cash is a sales optimizing process that helps you to automate and streamline your sales cycle with accuracy. When it streamlines your sales cycle, it asks for enhancing the buying experience for the customers at every step. It involves ten processes to improve the buyer experience. These are:

Revenue recognition is the ninth stage of the QTC process. After fulfilling the orders, with accurate billing, you can see cash flow, recognize and forecast revenue. The QTC enables you to cover all necessary elements in the quote and thus makes the billing accurate. This also assures proper handoffs from the sales operations to the finance dept by enabling the finance to review accounts receivables accurately. When your finance dept gets an accurate overview of the accounts receivable, it can count the revenue with 99.9% accuracy.

How does the QTC process help you to recognize and forecast your revenue?

We are explaining the key stages QTC considers to recognize and forecast your revenue.

Pricing:

Pricing is a crucial part of the contact you create for your customers. The accurate pricing comes after a lot of negotiations between the proposed and offered prices. When both parties; your sales department and customers agree upon a price, it’s become a crucial responsibility of your sales team to accurately calculate the price with discounts and mention in the bill and QTC empowers you to do that.QTC implementation not only recommends you the best product combinations but also it auto-calculates the price using discounts.When your finance dept receives the right billing amount which is the receivable by your business, they do right entries in your account book for the cycle.

Delivery schedule:

The delivery schedule plays an important role in recognizing revenue. It adds the ‘time of delivery’ to your sales cycle. QTC does all the background work and helps your sales team to build a feasible delivery schedule for all the orders. The delivery schedule enables you to identify the revenue for each cycle even before the delivery happens.

Net payment term:

The payment terms indicate the duration to a customer on how quickly you hope the team to pay your invoices. For example, Net 30 means the payment due is thirty days from the invoice date. QTC helps your sales team to use the right net payment terms automatically as per the contract. As the contract is drastically changing documents, QTC gives visibility of the net payment term to the finance dept in a few clicks.

GL entries both for receivable and liabilities:

The GL or General Entries enables you to keep a record of all transactions happening in both debit and credit accounts and it is validated by a trial balance. QTC helps your businesses with accurate GL entries both for receivables and liabilities. It empowers the finance dept to have a correct understanding of the payment gap between receivable and liabilities to figure out the revenue correctly.

Business Resilience with QTC

If the contracting terms are not clear, businesses find it difficult to track and recognize revenue. Right from building quotation till delivery and billing, QTC integrates all the stages in your sales cycle by giving vivid visibility of all the transactions. Thus, it helps to track and forecast your revenue. Right revenue recognition builds resilience for your business.

When you implement QTC with us, we help customize the same as per your requirements and you can leverage Salesforce and Apttus solutions through our partnership.

Get in touch with us to track your revenue with our custom QTC implementation.

About CommerceCX: CommerceCX is a global consulting, design, and development firm. We provide organizations with the solutions and services that support the transformation of a commerce ecosystem. We specialize in CRM, Quote-to-Cash, Lead to Cash, and have strong expertise in Salesforce, Apttus, and Microsoft Technologies. Leveraging our solutions, organizations can connect technology, data, and insights to unify and enhance the buying, selling, and service experience that powers the commerce ecosystem.