OTC or Order to Cash is the core business process that determines cash flow and revenue in your organization. This process encompasses the whole sales cycle of your organization. It starts with customers placing the orders and ends with recording the payment in the general ledger. The whole OTC process involves many phases including placing orders, fulfilling orders, shipping, sending invoices, payment, and recording the payment in the general ledger.

A conventional OTC process is complex and you need a fully dedicated team to handle it. There is a lot of data and repetitive processes which take your valuable time. Sometimes there is a scope of errors in an entry, calculation, and credit limit. But with automation implementation, you can enhance your existing OTC process with predictability and accuracy. You can have an understanding of your working capital, cash flow, and revenue with an automated OTC process.

Read this post to know the top automation challenges and solutions to your OTC process.

#Challenge 1: OTC Automation is confusing

Most businesses think that OTC automation is confusing. Automation decreases human intervention in processes to zero down errors. It also automates repetitive processes to save your time for more important tasks. When you automate your existing OTC process, you need to change many processes. Most CEOs find it confusing to move from an existing OTC process to the new one in the fear of too much transformation and cultural change.

#Challenge 2: You need a new dept to accelerate OTC automation projects

Automation related to RPA has become a cliche but not clear. People talk more about their benefits rather than the implementation process. Most CTOs are clueless about how they can automate their existing OTC process. They have fear of deploying more human resources and capital to accelerate the OTC process.

#Challenge 3: Automated OTC processes are difficult to scale

Chris Gardner, the principal analyst at Forrester reveals that thousands of automation bots are beyond the expertise of many companies. Due to this, the service market to accelerate RPA is rising. Hence, most businesses think that automated OTC processes are difficult to scale.

Why you need to automate your OTC process?

The IBM Institute for Business Value reveals that an advanced order to cash can enhance the performance of any company up to 83%. Automation frees up employees’ time to spend on critical projects. This same study also reveals that OTC automation can enhance the end-to-end cycle of any company up to 60%.

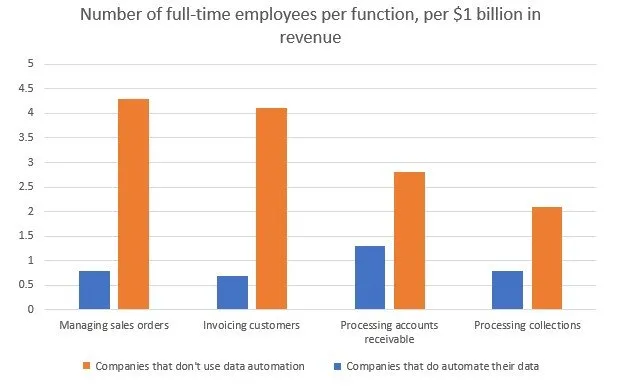

You can see the distinct differences between the companies using data automation and the ones which don’t:

Automation is bliss for the OTC process

Although companies find it challenging to scale the automated OTC process, automation is a blessing. When you automate your existing OTC process, you increase productivity, decrease lead time, and smoothen your cash flow. Moreover, order processing becomes faster as it speeds up the accounts receivable process. With an automated OTC, you reach a better position to convert your orders into revenue.

The key automation strategies to improve your order to cash cycle are: